Financial Highlights

| (Dollars in MM Except Per Share Amounts) | 2023 | 2022 | Change |

|---|---|---|---|

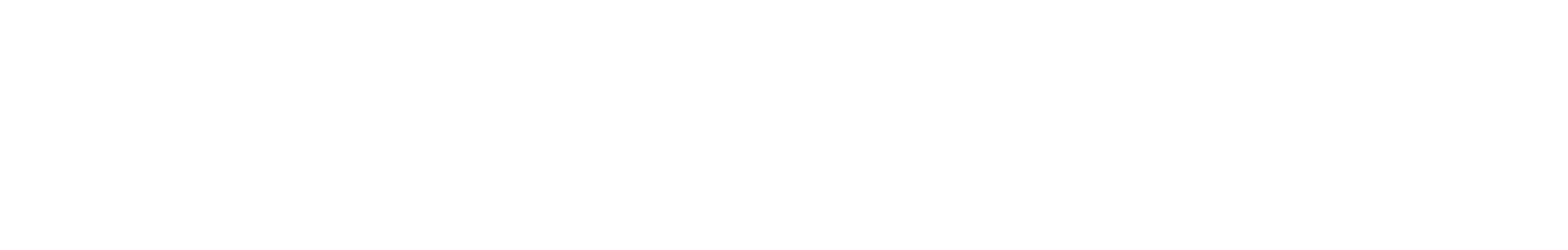

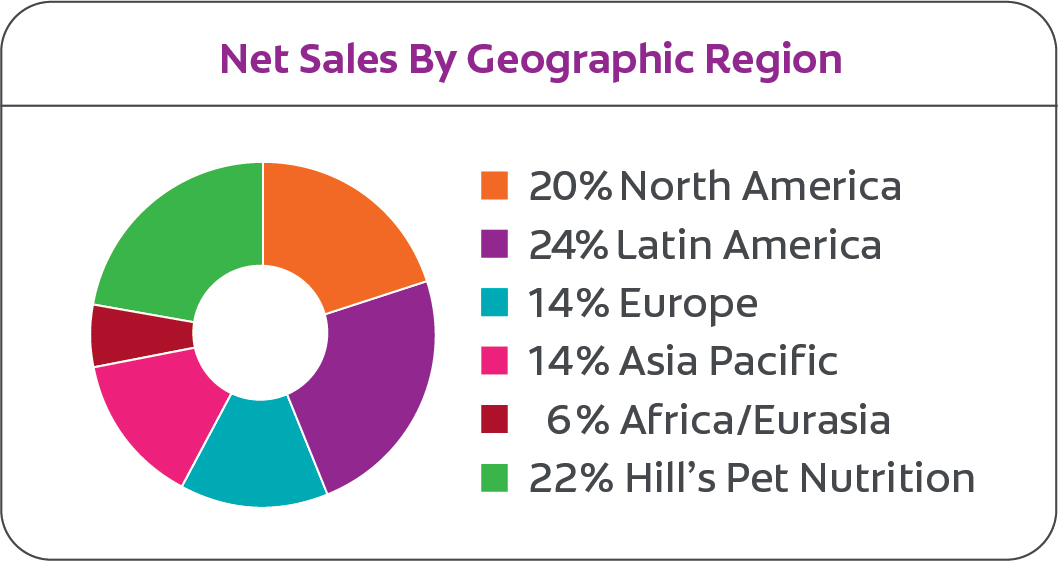

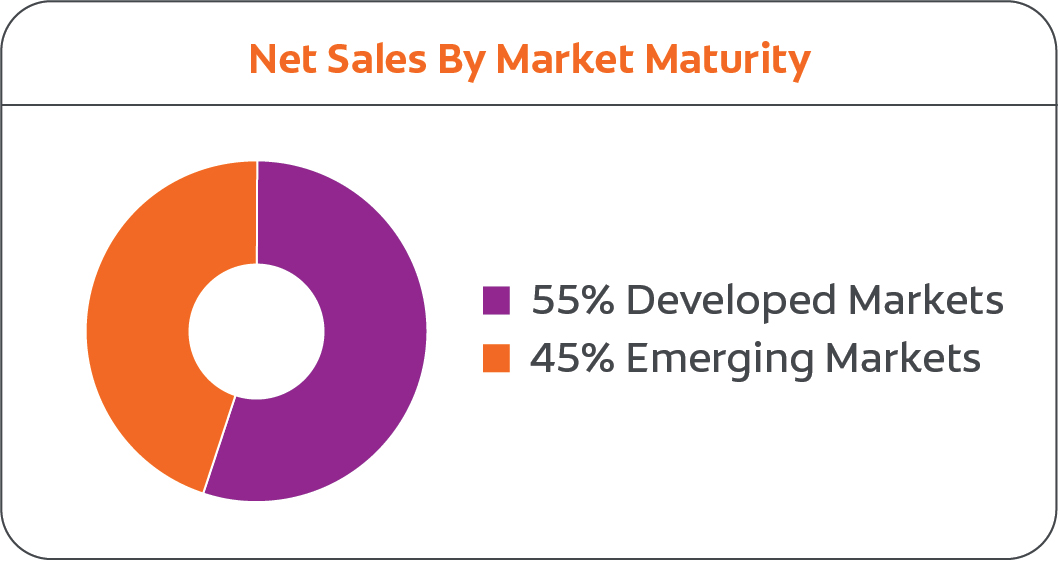

| Worldwide Net Sales | $19,457 | $17,967 | +8.5% |

| Organic Sales Growth | +8.5% | ||

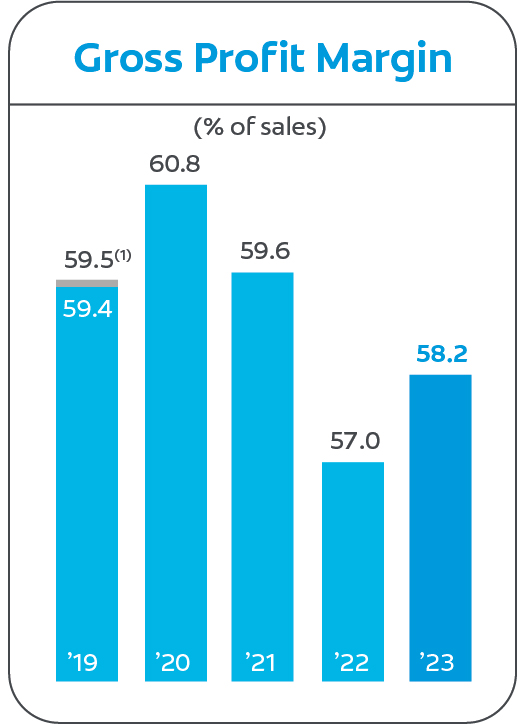

| Gross Profit Margin | 58.2% | 57.0% | +120 basis points |

| Operating Profit* | $3,984 | $2,893 | +38% |

| Operating Profit Margin* | 20.5% | 16.1% | +440 basis points |

| Net Income Attributable to Colgate-Palmolive Company** | $2,300 | $1,785 | +29% |

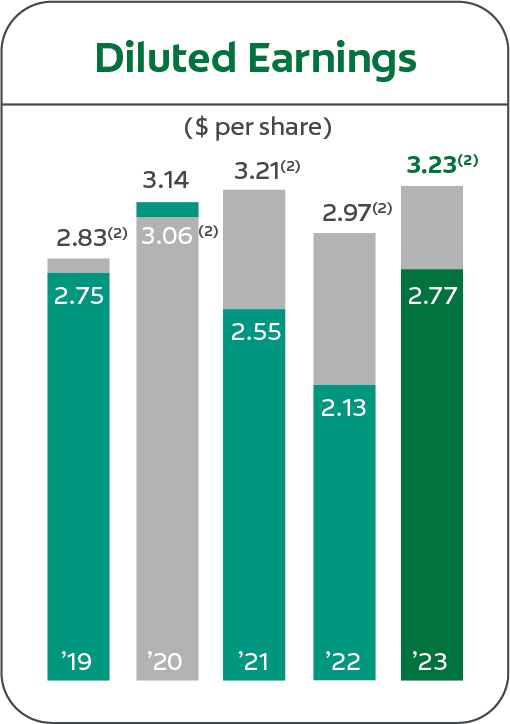

| Diluted Earnings Per Share** | $2.77 | $2.13 | +30% |

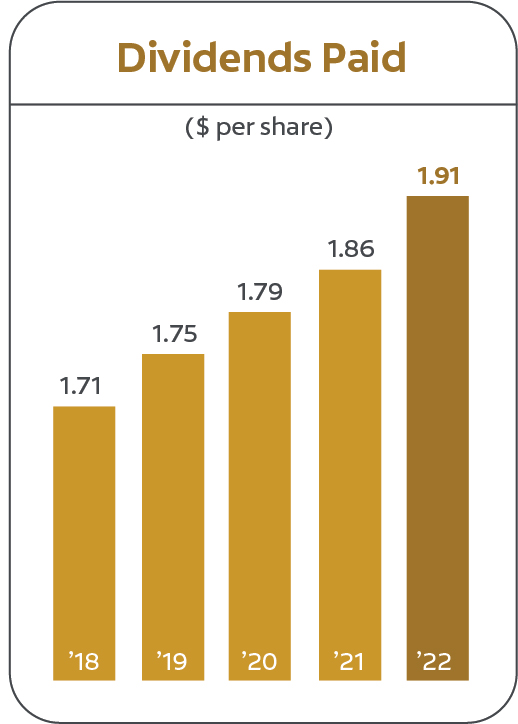

| Dividends Paid Per Share | $1.91 | $1.86 | +3% |

| Operating Cash Flow | $3,745 | $2,556 | +47% |

| Year-end Stock Price | $79.71 | $78.79 | +1% |

*2023 includes charges related to the 2022 Global Productivity Initiative and product recall costs. 2022 includes goodwill and intangible assets impairment charges, charges related to the 2022 Global Productivity Initiative, a gain on the sale of land in Asia Pacific and acquisition-related costs. For a complete reconciliation between reported results (GAAP) and results excluding these items (non-GAAP), including a description of such items, please click here.

**2023 includes charges related to an ERISA litigation matter, a foreign tax matter, the 2022 Global Productivity Initiative and product recall costs. 2022 includes goodwill and intangible assets impairment charges, charges related to the 2022 Global Productivity Initiative, a gain on the sale of land in Asia Pacific and acquisition-related costs. For a complete reconciliation between reported results (GAAP) and results excluding these items (non-GAAP), including a description of such items, please click here.

(1) 2019 excludes charges related to the Global Growth and Efficiency Program. For a complete reconciliation between reported results (GAAP) and results excluding this item (non-GAAP), please click here.

(2) 2023 excludes charges related to an ERISA litigation matter, a foreign tax matter, the 2022 Global Productivity Initiative and product recall costs. 2022 excludes goodwill and intangible assets impairment charges, charges related to the 2022 Global Productivity Initiative, a benefit from the gain of the sale of land in Asia Pacific and acquisition-related costs. 2021 excludes goodwill and intangible assets impairment charges, a loss on early extinguishment of debt and a benefit from a value-added tax matter in Brazil. 2020 excludes benefits related to the Global Growth and Efficiency Program, a benefit related to subsidiary and operating structure initiatives, acquisition-related costs and a loss on early extinguishment of debt. 2019 excludes charges related to the Global Growth and Efficiency Program, acquisition-related costs, a benefit from a value-added tax matter in Brazil and a benefit from Swiss income tax reform. For a complete reconciliation between reported results (GAAP) and results excluding these items (non-GAAP), including a description of such items, please click here.